Pitch. Click. Funded. Alixco Showcases its Vision at Slush’d Penang 2025: Unlocking Growth for Malaysian SMEs Through P2P and ECF Innovation.

George Town, Penang – 20 May 2025 – In a bold display of fintech innovation and entrepreneurial empowerment, Andre Betker, Co-Founder and Chief Investment Officer of Alixco, took center stage at Slush’d Penang 2025 to share how Malaysia’s equity crowdfunding (ECF) and peer-to-peer (P2P) financing ecosystem is revolutionizing SME growth.

Held in the heart of the UNESCO World Heritage Site of George Town, this year’s Slush’d Penang carried the theme “Between Worlds” reflecting the urgent need to bridge traditional boundaries in an increasingly divided global landscape. Betker’s keynote, titled “Pitch. Click. Funded.”,struck a powerful chord with investors, entrepreneurs, and digital visionaries alike.

Breaking Barriers in SME Financing

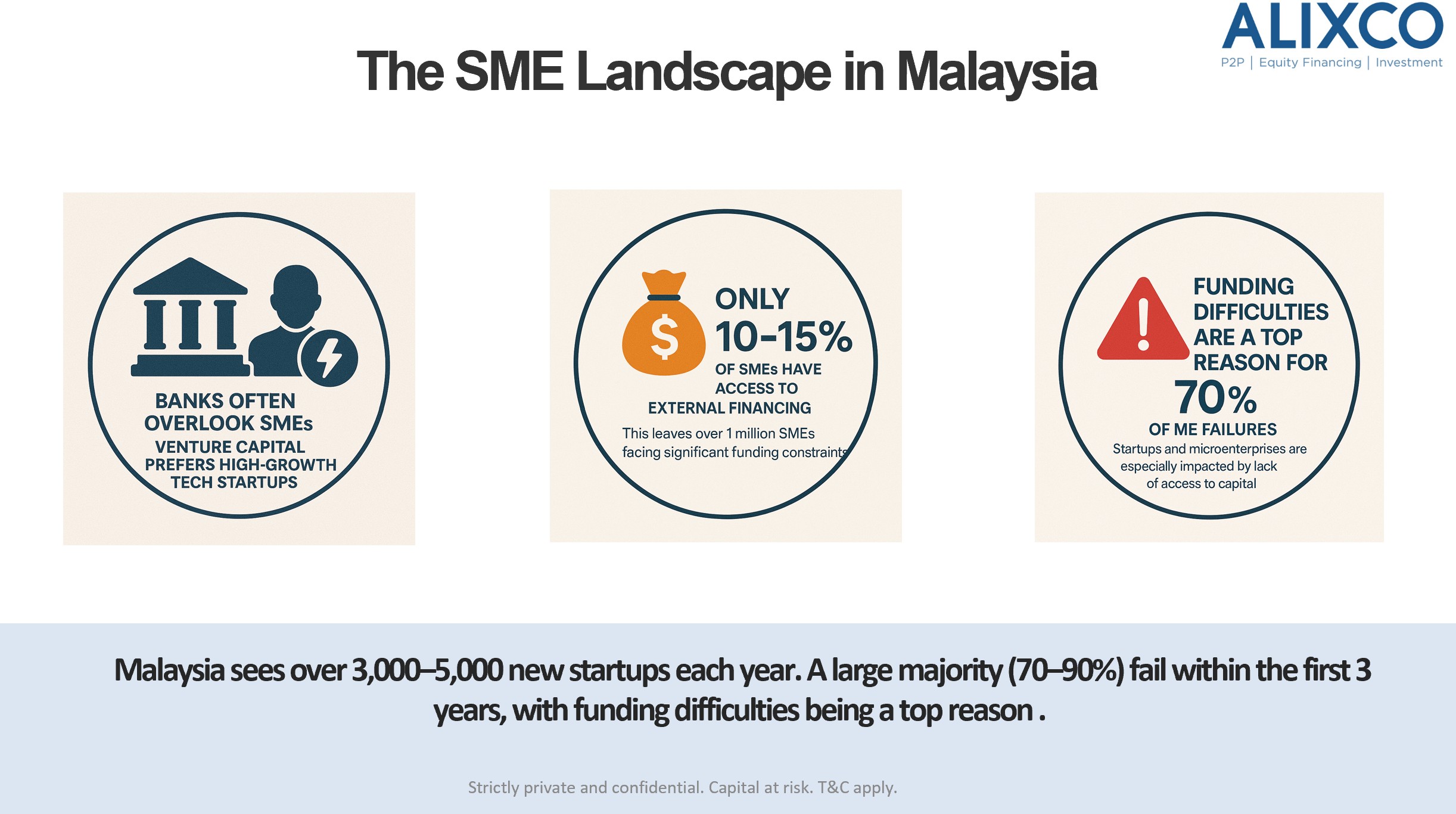

In a country where 97.4% of businesses are MSMEs, Betker highlighted a crucial challenge: Malaysia’s SME financing gap exceeds USD 20 billion. Traditional funding options, often slow, collateral-heavy, and paperwork-intensive, are failing the very businesses that form the backbone of the national economy.

"Too many great business ideas in Malaysia die not due to poor execution, but because they hit a wall during funding,” said Betker. “At Alixco, we’re turning that around with digital-first, investor-backed financing solutions that work at startup speed.”

Alixco’s Model: Transparent. Fast. Empowering.

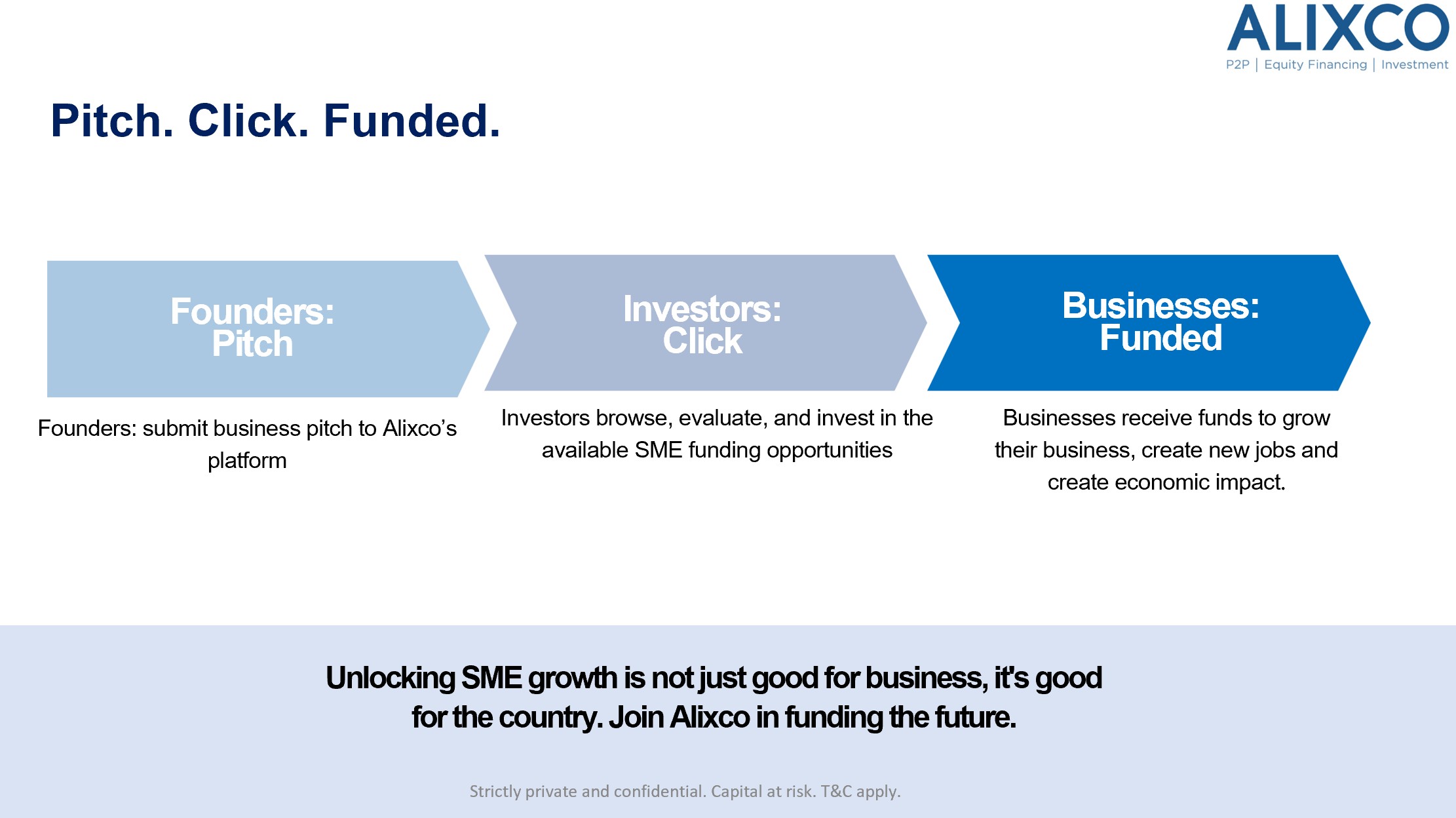

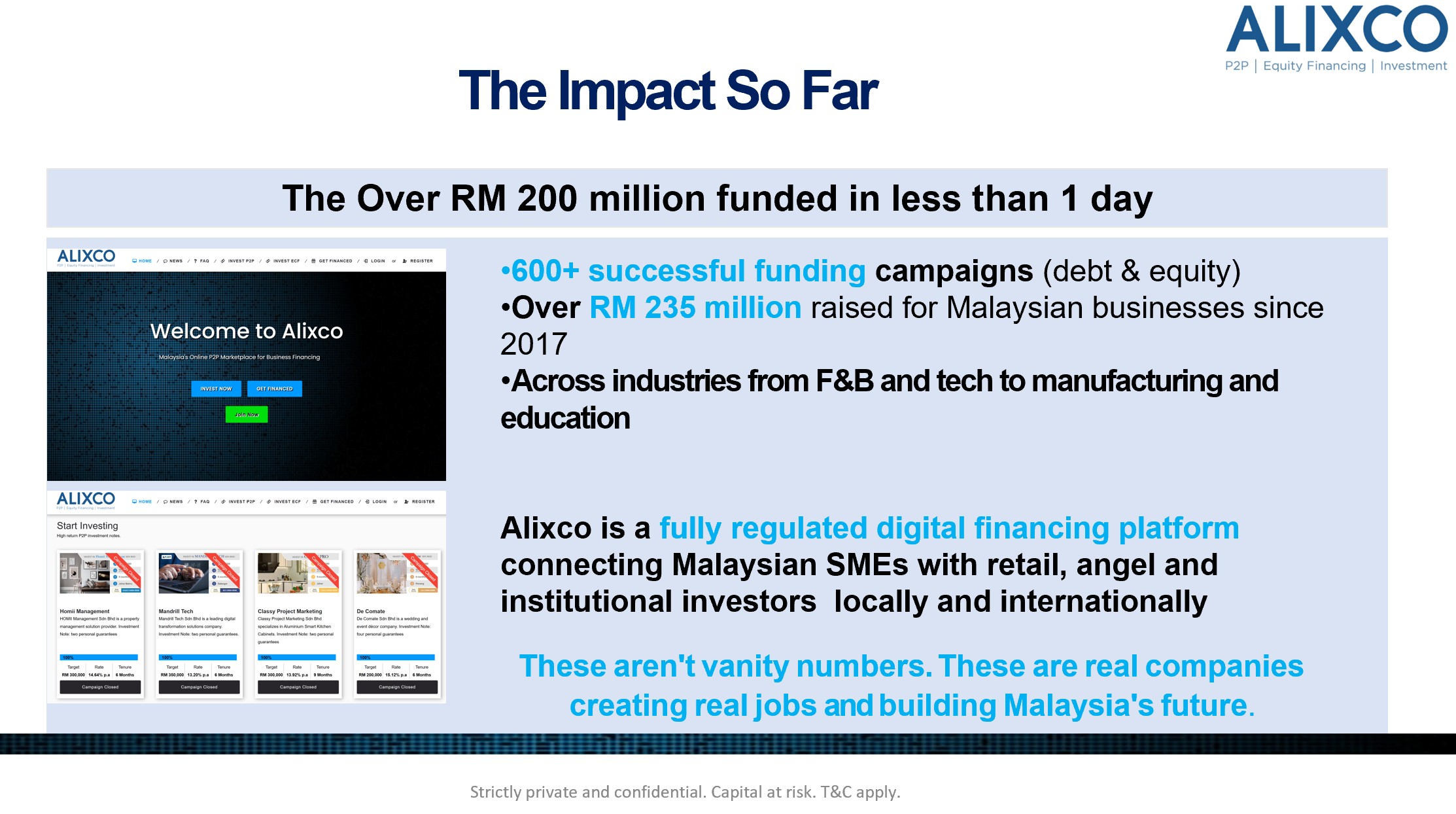

Alixco’s regulated ECF and P2P financing platform connects Malaysian SMEs directly with retail, angel, and institutional investors, both locally and globally. The process is as simple as: Pitch. Click. Funded.

Founders pitch their business online

Investors browse, evaluate, and invest digitally

Businesses receive funds in as little as 1–7 days

With over 600 funding campaigns completed and RM 235 million raised since 2017, Alixco is rapidly emerging as a market leader. Notably, 95% of its P2P campaigns are fully funded in under 24 hours, showcasing the platform’s efficiency and investor confidence.

Opportunities for Issuers: Why Alixco Stands Out

Andre’s presentation was particularly impactful for potential issuers, emphasizing how businesses can raise up to RM 20 million through ECF, with flexible terms, global investor exposure, and strategic support. For SMEs seeking working capital, P2P financing provides a fast, collateral-light alternative to bank loans, with nominal interest rates from just 0.8% per month

.

“We don’t just fund companies, we fund futures”, Betker remarked. “Whether you're a fast-scaling tech startup or a women-led social enterprise, Alixco helps you access capital, unlock growth, and create real economic impact.

Credibility, Regulation, and Trust

Alixco is regulatedby the Securities Commission Malaysia and adheres to strict AML/KYC compliance, giving both issuers and investors peace of mind. With full transparency, strong investor protection mechanisms, and nominee structures, Alixco’s credibility continues to grow both locally and internationally.

A Glimpse Into the Future

Andre also unveiled Alixco’s innovation roadmap, which includes:

- Tokenized assets and fractional ownership

- AI-driven credit scoring and predictive analytics

- Secondary market trading for investment liquidity

- Cross-border funding partnerships

These advancements are poised to further disrupt traditional finance and provide borderless capital access to Malaysian SMEs.

Alixco at Slush’d: A Catalyst for Growth

Slush’d Penang 2025 was more than a tech gathering, it was a movement for bold ideas. Andre Betker’s talk affirmed Alixco’s position at the forefront of fintech innovation in Southeast Asia.

For investors, Alixco offers high-impact opportunities to support real businesses with real returns. For SMEs, it’s a chance to break free from funding limitations and scale with confidence.

Join the movement. Fund the future. One pitch. One click. One deal at a time.

Ready to grow your business with Alixco?

Register now at www.alixco.com/register and explore ECF and P2P financing opportunities tailor-made for Malaysian SMEs.

Important Disclaimer: T&C apply. Investments in P2P and ECF campaigns may lead to the loss of the entire capital invested. Do not invest more than you can afford to lose. This is not an offer or solicitation to make any type of investments. This article has not been reviewed by the Securities Commission Malaysia.