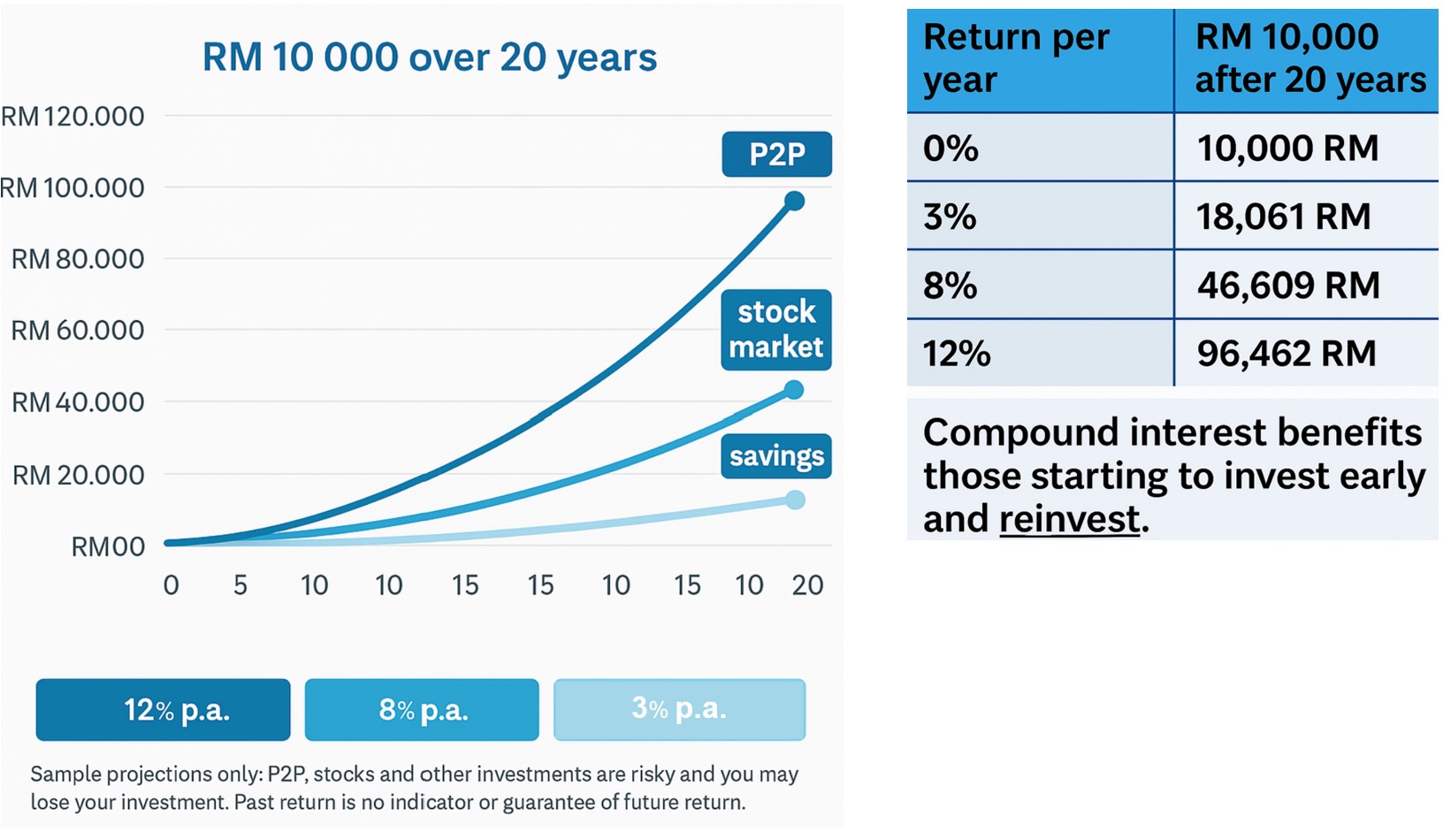

Investment Statistic

Alixco offers 11.26% average annual returns. 97.6% repayment rate. Only 2.4% low default rate since 2018. Trusted P2P investment platform in Malaysia.

Alixco P2P Investment Returns, Risk Ratings & Market Statistics

Consistently High Returns for Alixco Investors – Over 11.26% p.a. Net Average

At Alixco, investors have consistently achieved strong returns through our peer-to-peer (P2P) financing platform in Malaysia.

From our launch in 2018 until January 2025, the net average annual return (after fees and defaults) for investors was 11.26% p.a. (nominal) – with many investors earning even more depending on portfolio choices and diversification.

The average interest rate for business financing notes listed on Alixco stood at 13.52% p.a. (nominal), showcasing the attractive yield potential of our platform.

These statistics are based on over seven years of real investment data, highlighting our strong track record and commitment to delivering reliable returns in Malaysia’s fast-growing P2P lending sector.

At Alixco, we remain committed to:

- Offering high-quality investment notes with above-average returns

- Conducting thorough due diligence on all borrower businesses

- Empowering investors with transparency, diversification options, and a robust risk framework

Whether you're a seasoned investor or just getting started, Alixco offers one of the most rewarding and trustworthy P2P investment experiences in Malaysia.

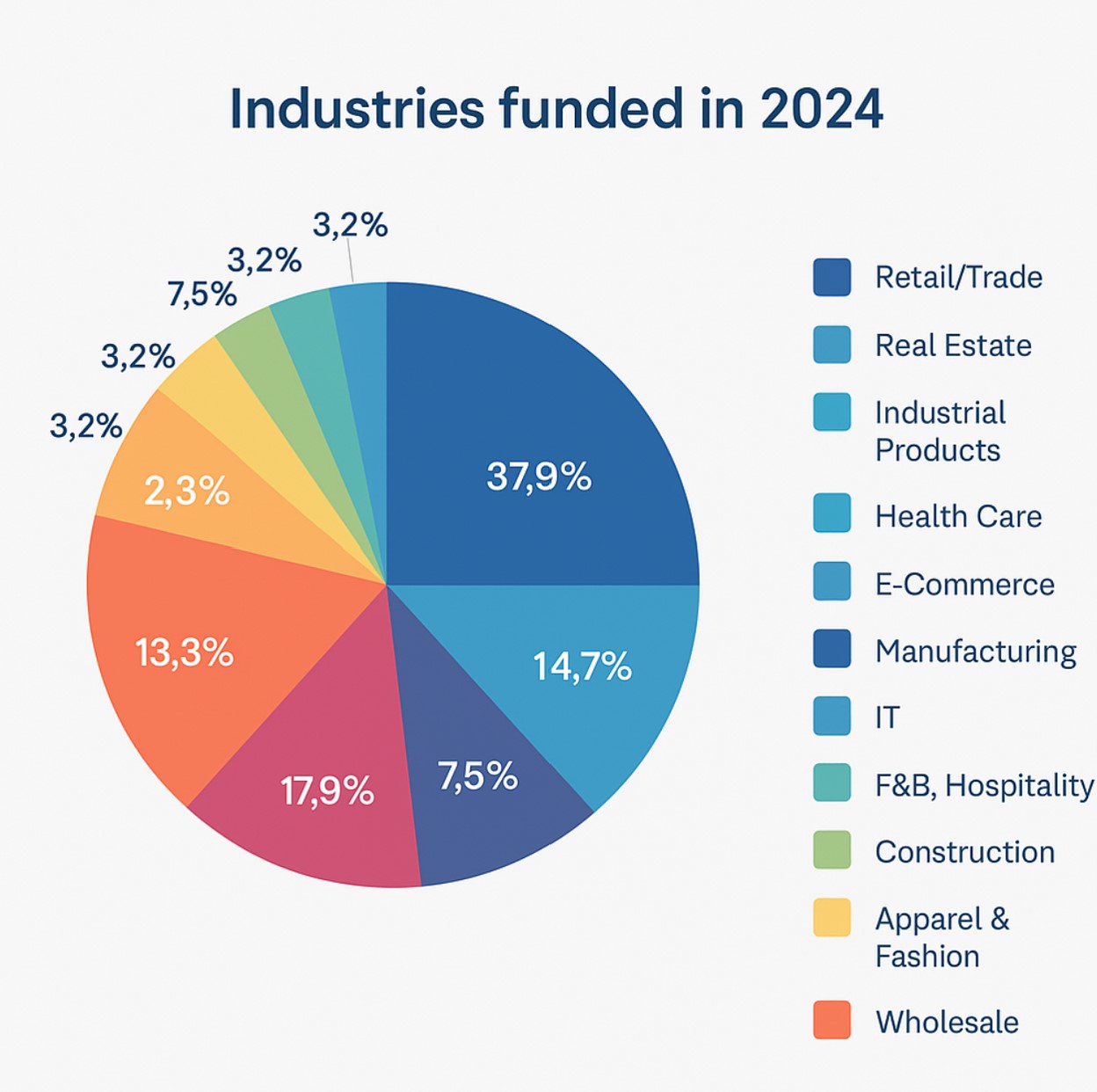

Diversified Industry Exposure – P2P Investments Across Malaysia’s Key Sectors

In 2024, Alixco funded businesses across a wide range of industries, offering investors broad exposure and diversified risk.

The Retail/Trade sector led with 37.9% of total funded volume, reflecting strong demand from consumer-facing businesses.

Manufacturing and Wholesale followed at 17.9% and 13.3%, respectively, highlighting our support for Malaysia’s industrial backbone.

Other notable sectors included Real Estate (14.7%), IT (7.5%), F&B/Hospitality (7.5%), and E-Commerce, Healthcare, and Construction – each at 3.2%.

This diverse portfolio enables Alixco investors to benefit from multiple economic growth drivers while minimizing reliance on any single sector.

At Alixco, we carefully vet businesses from both emerging and established sectors—ensuring every note meets our standards for quality, transparency, and return potential

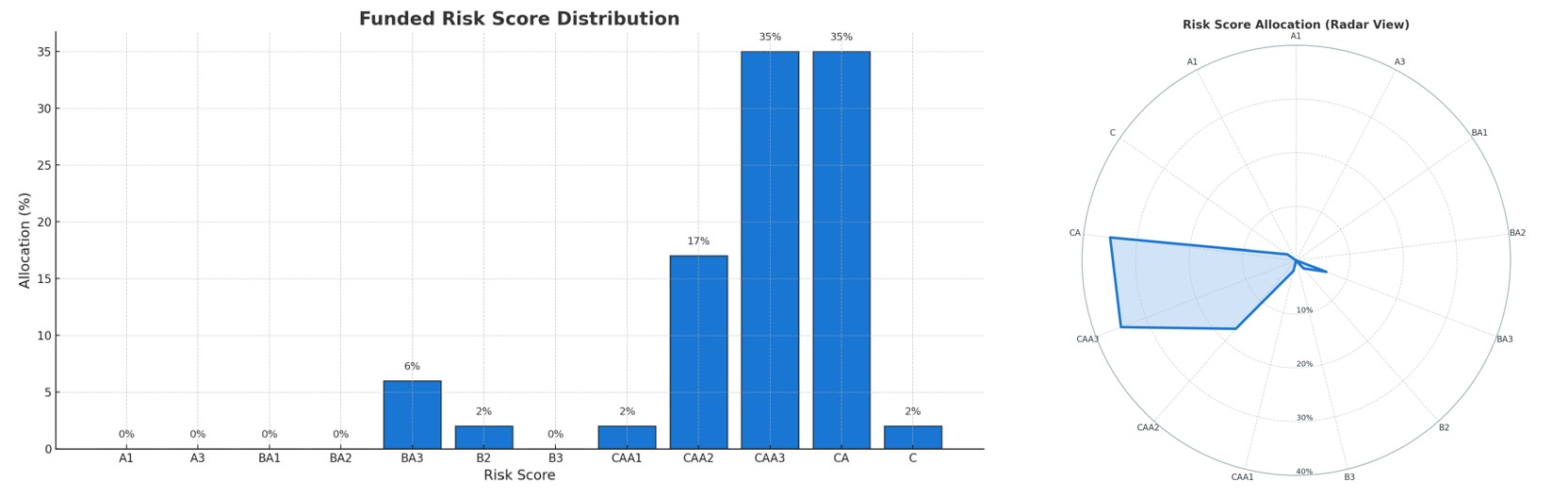

Distribution of risk scores

Balanced Risk Allocation – Insight into Funded Risk Scores

At Alixco, we maintain a transparent and data-driven approach to risk assessment. The majority of funded notes in 2024 were allocated to mid-risk and high-risk categories, offering an optimal balance of attractive returns and manageable risk for investors.

70% of all funded notes were rated CAA2 (35%) and CAA3 (35%), which historically offer higher yields while maintaining a controlled default rate through strict vetting.

17% were rated CA, while small allocations were made to medium--risk ratings like BA3 (6%) and B2/B3/CAA1/C (2% each).

No allocations were made to A-rated categories, as these segments often carry lower yield potential inconsistent with our investors’ return targets.

The radar chart provides a visual overview of risk exposure concentration, helping investors better understand the credit distribution of Alixco’s investment opportunities.

By focusing on disciplined risk selection, Alixco aims to maximize investor returns while actively managing credit exposure across Malaysia’s growing business landscape.

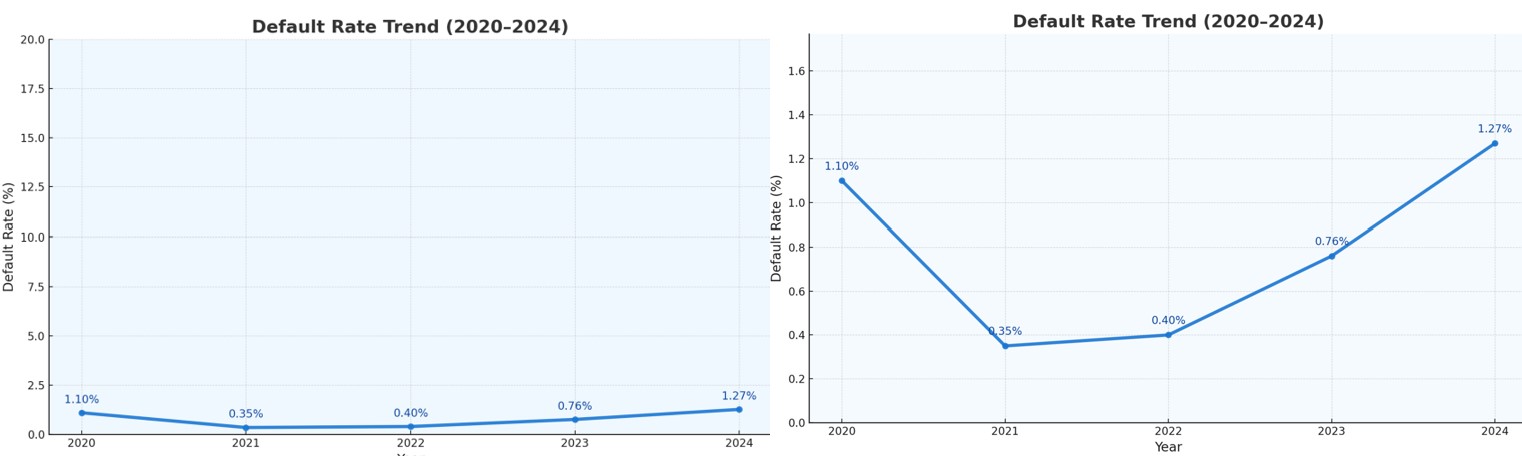

Strong Repayment Performance – Over 97.6% of Alixco Investments Fully Repaid

At Alixco, investor protection and repayment reliability are at the core of our platform.

Since our inception, over 97.6% of investments have been fully repaid, with a low default rate of just 2.4%, as of 18 June 2025. Based on repayment value, our business financing investment notes have achieved a repayment rate exceeding 98% — a strong indicator of our platform’s credit quality and risk management.

Default Rate (as defined by the Securities Commission Malaysia): 2.4%

Number of unique issuers with notes in default (>90 days late): 5

Alixco continues to enhance both its mathematical credit scoring models and social-based risk assessment tools to reduce potential defaults and protect investor capital.

Our goal remains clear: to offer high-yield investments without compromising on due diligence or repayment performance, making Alixco one of the most trusted P2P investing platforms in Malaysia.

RMO-P2P Operators shall compute its default rate with the following formula and disclose the same on its platform:

i.e. The denominator will essentially be the amount financed plus the interest that is promised to investors at the point of issuance. This includes Active Notes, Defaulted Notes and Written Off Notes if any

Note:

Active Notes refers to notes issued on P2P Platform which are not in default

Defaulted Notes refers to notes which is classified as default as per P2P Operator's definition

Written Off Notes or any similar definition refers to notes which are in default and has not yet been recovered.

Please note that repayment rates, default rates and investment returns (both nominal and effective) are historical returns which have been realized on investment hosted on Alixco up the the stated date. Please note that these rates and returns are not necessarily an indication of future performance. Future default rates and investment returns may differ substantially from the stated historical default rate and returns.

Investor Protection & Risk Safeguards

At Alixco, investor protection is a top priority. Our platform is designed to ensure secure, transparent, and reliable P2P investments through multiple layers of risk assessment, legal safeguards, and contingency planning.

Comprehensive Credit Analysis Process

Alixco implements a rigorous 3-step credit evaluation before funding any business financing investment note:

Mathematical Z-Score Model: An internal, multi-factor scoring model based on key financial ratios of the issuer.

Third-Party Credit Rating: An additional score from Experian (formerly RAMCI), covering the credit history of the company and its directors.

Social Scoring Algorithm: Our proprietary model that evaluates the credibility and repayment behavior of key individuals associated with the business.

This layered approach enhances our ability to identify strong issuers and minimize default risk.

Personal Guarantees

Each business financing investment note requires at least two personal guarantees from key persons or directors, strengthening the enforceability of repayment obligations.

Legally Binding Contracts

All investment notes are formal contractual agreements between the issuer and investor, backed by Malaysian stamp duty to provide legal enforceability in court if needed.

Debt Recovery Partnerships

In the event of a default, Alixco works with a leading debt recovery agency to actively pursue and recover outstanding payments from issuers, maximizing potential recovery for investors.

Living Will for Platform Continuity

To safeguard investors in the unlikely event of platform disruption, Alixco has a Living Will arrangement in place. This mandates that a designated law firm will take over the processing of all outstanding repayments until each note reaches maturity—ensuring business continuity and investor peace of mind.