Johnids Design

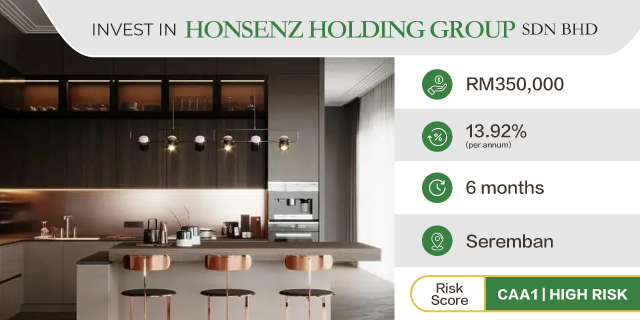

Johnids Design is a fast-growing and award-certified interior and architectural design company in Northern Malaysia. Investment Note: one personal guarantee

Risk-Score

C

C

100%

Target

RM 50,000

RM 50,000

Rate

16.20% p.a

16.20% p.a

Tenure

6 Months

6 Months