FAQ

Got questions? We’ve got answers.

- What is Alixco P2P Financing?

Alixco is Malaysia’s premier digital investment marketplace, connecting everyday investors with promising local businesses. As a Registered Market Operator (RMO) regulated by the Securities Commission Malaysia, we enable SMEs to access fast, affordable capital—and empower investors to earn high, fixed-income returns through carefully vetted investment opportunities

Think of us as a smarter, faster, and more transparent alternative to traditional lending and investing.

- What is P2P Financing?

P2P financing is a modern investment model that lets you, as an investor, directly fund Malaysian SMEs, cutting out banks and other middlemen.

-

Investors earn attractive monthly returns (up to 16% p.a.)

-

Businesses get quick, short-term financing (RM 50k–1 million)

-

Transparent, regulated, and risk-rated

P2P is democratizing finance, making investing accessible from as low as RM 200, and funding accessible to businesses in need of working capital.

P2P is called peer-to-peer lending in some countries but peer-to-peer financing in Malaysia due to regulatory implications.

-

- How does P2P financing work on Alixco?

It’s simple, secure, and seamless.

-

Browse investment opportunities posted by verified Malaysian SMEs on AlixCo’s website

-

Choose a campaign that matches your preferences and risk profile.

-

Invest by simply hitting the ‘Invest’ button on the campaign page. The amount will be deducted from your available balance.

-

Earn returns monthly (or upon maturity), directly into your Alixco account. All repayments including interest will be automatically transferred back to your Alixco account. Simple as that!

All investments are contractually backed, risk-assessed, and legally binding.

All payments are routed through Maybank Trustee Berhad—Alixco never touches your money directly.Alixco only accepts bank transfers from verified users' own bank accounts. Cash deposits are not allowed

This policy is in place to ensure compliance with financial regulations and to maintain the security of your transactions. -

- Is Alixco regulated ?

Yes. Alixco is fully regulated by the Securities Commission Malaysia (SC).

We operate under the legal entity FBM Crowdtech Sdn Bhd (1167599-X) and are independently audited, with full regulatory compliance in areas of:

-

Risk management

-

AML/CFT and investor onboarding

-

Trustee-secured payment flows

-

Transparent fee structures and disclosures

Verify us on SC’s official site →

-

- Who is the team behind Alixco?

Alixco is led by a seasoned, international team combining the best of fintech, investment, and risk management expertise from Europe and Asia:

Our in-house teams include German IT architects, seasoned legal counsel, and experienced credit risk analysts—all committed to building the most trusted digital finance platform in Southeast Asia.

- How can I report impersonation scams or fraudulent use of the Alixco name?

If you suspect a scam or have been approached by someone impersonating Alixco:

-

Do NOT transfer any funds.

-

Call Alixco or send an email to support@alixco.com or report.misconduct@alixco.com

-

Report the case immediately to the National Scam Response Centre (NSRC) at hotline 997 . The affected party (scammed investor or issuer) must make the report personally.

-

You may also file a police report and notify the NSRC via their website: https://nfcc.jpm.gov.my

Note: Alixco itself is not authorized to file police reports on behalf of investors or issuers. It is the responsibility of the affected individual to report the incident directly to the authorities.

-

- What happens to my money in case something happens to Alixco e.g. bankruptcy?

Your money is securely placed in a Trust account with a major Malaysian bank. Alixco has a living will in place for this scenario so that you will get back your money.

In the unlikely event that Alixco ceases operations due to insolvency or other circumstances, a Business Continuity Plan will be activated to ensure investors' interests are protected.

Under a "Living Will" agreement, Alixco has appointed Crowd Tech Nominee Sdn Bhd as the Inheriting Partner to take over all outstanding investment obligations. This means:

The Inheriting Partner will continue managing investment notes, collection services, and recoveries on behalf of investors.

Late payments and outstanding amounts will still be collected and redistributed until all obligations are fulfilled.

Investors' funds and repayments remain safeguarded under the nominee structure.

This ensures that in the event of Alixco's closure, all live investment notes will continue to be administered efficiently, with recovery processes carried out as needed.

- Who can invest on Alixco?

Anyone aged 18 and above with no legal restrictions in their country may invest through Alixco.

We welcome:

-

Retail investors

-

High-net-worth individuals

-

Institutional investors

-

Corporations & businesses

All you need is a verified Alixco account and a personal or business bank account to get started.

-

- How does P2P investing work on Alixco?

It’s simple, fast, and secure:

-

Browse verified campaigns by Malaysian SMEs

-

Choose the ones that fit your goals

-

Invest (starting from just RM200) via bank transfer

-

Earn monthly returns, repaid directly to your Alixco wallet

All repayments and capital go through our trustee account at Maybank, ensuring maximum transparency and investor safety.

-

- When do I transfer the funds?

Once you commit to invest in a campaign, you’ll receive an automated email with payment instructions. You can then transfer the investment amount from your own bank account. We do not accept third-party transfers or cash deposits.

- What’s the minimum investment?

The minimum investment starts at RM200 per campaign giving you the flexibility to diversify even with a small portfolio.

- What information will I receive about the issuers?

Transparency is our priority. For every investment opportunity, you’ll receive:

-

A detailed company factsheet

-

Purpose of fundraising

-

Creditworthiness and internal risk score

-

Business model and key financials

-

Personal guarantor info (where applicable)

You know exactly who you’re investing in.

-

- Where is my money held?

All investor funds are held in a dedicated trust account with Maybank Trustee Berhad, a leading bank in Malaysia. Alixco never touches your money directly.

- Are there any investor fees?

We charge a small fee only on repayments between 0.35% to 2%, depending on campaign structure and tenure.

No upfront fees

No fee if there’s no repayment

Investors keep 98–99.65% of their total repayments - What if an issuer is late with repayment?

We have a 3-step late payment process:

-

Reminder & grace period notice

-

Late fee penalties charged to issuer

-

Legal action against directors & guarantors

Investors will be informed throughout. Legal recovery is initiated promptly if delays continue.

-

- What happens if an issuer defaults?

Default risk exists with all investments. But at Alixco:

-

We cover legal fees for enforcement

-

We pursue court action and recovery

-

Approx. Over 50% of default cases result in recoveries

Note: Alixco investments are not guaranteed and not covered by the Capital Market Compensation Fund.

Investments made through the Alixco platform are not covered by the Capital Market Compensation Fund. This means any losses incurred cannot be claimed from the Fund.

-

- How can I find legal updates for late-paying or defaulted issuers?

To check legal updates related to late or defaulted issuers:

1. Navigate to the Dashboard at the top menu.

2. Click on Repayment in the left-hand menu.

3. Select the LATE tab at the top of the screen.

Use the search bar to find the relevant issuer (e.g., "ISSUER NAME").

Legal proceedings and updates (e.g. court dates, applications) will be displayed on the right-hand side.

This section is regularly updated with any legal enforcement actions or recovery efforts undertaken by Alixco.

- Should I invest only in campaigns with the highest interest rate?

Not necessarily. High returns often come with higher risk.

We strongly recommend:-

Diversifying across multiple campaigns

-

Spreading your investments by tenure and sector

-

Considering your own financial goals and risk appetite

Smart diversification = better risk management.

-

- Why are interest rates different between campaigns?

This is called risk-based pricing. Our internal proprietary risk scoring model gives a score for each issuer based on financials, quantitative as well as qualitative data. The risk score should be commensurate with the amount of risk investors are taking. This is designed to compensate investors appropriately for the risk they are taking.

Interest rates reflect:-

The SME’s risk score (credit & business profile)

-

Financial health

-

Tenure & funding size

Usually, the following applies:

Higher interest rate = higher return potential but also higher risk

Lower interest rate = lower return potential but also slightly lower risk

-

- What is the meaning of the Risk Scores A - C ?

Every business listed on Alixco P2P is assessed using a proprietary credit-risk scoring model that evaluates financial strength, payment history, business stability, and guarantor credibility. The result is a credit rating that helps investors gauge the relative risk level of each investment opportunity.

Our risk grades range from AAA (lowest risk) to D (in default). These ratings are derived from a combination of financial data (e.g., profitability, leverage, liquidity), behavioral data (e.g., repayment record, CTOS/SSM data), and qualitative assessments (e.g., management background, industry outlook).

Important risk warning: Independent of the risk rating, every investment note, including those rated A or better, have a certain risk of non-payment and default. For avoidance of doubt, this means that an investor may lose part or all of his/her investment. There is no absolute guarantee when it comes to P2P investments!

Credit rating Scale:

Rating Category Description AAA Prime Excellent financial health and low risk of default. Typically reserved for top-tier, highly stable companies. AA1

AA2

AA3

Very Strong Very high capacity to meet obligations; limited sensitivity to business or economic changes. A1

A2

A3

Strong Strong financials and operating history; low default probability but may be slightly more affected by external conditions. BAA1

BAA2

BAA3

Moderate Adequate financial position; some exposure to adverse economic conditions but generally reliable. BA1

BA2

BA3

Fair Moderate risk; repayment capacity exists but depends on stable operations or guarantor support. B1

B2

B3

Weak Higher risk of payment delay; business or cash flow vulnerability observed. Investors should expect higher returns. CAA1

CAA2

CAA3

CA

Very Weak High likelihood of repayment difficulty; significant dependency on external funding or guarantees. D Default In default or issuer is insolvent. Recovery actions may be ongoing. Why are there finer grades such as BAA1, BAA2, BAA3 (or B1, B2, B3)?

Each main rating category (for example BAA, BA, or B) is further divided into three sub-levels 1, 2, and 3 to show finer distinctions in credit quality within that category.

The “1” suffix (e.g. BAA1) indicates that the issuer is at the stronger end of that rating band.

The “2” suffix (e.g. BAA2) represents a mid-range position within the band.

The “3” suffix (e.g. BAA3) shows that the issuer is at the weaker end of the category but still above the next lower rating.

This finer grading provides investors with a more precise risk assessment, helping you compare issuers more accurately when constructing a diversified portfolio.

For example, a BAA1 issuer is generally viewed as slightly safer than a BAA3 issuer, even though both fall within the same overall “Moderate” risk category.Important Notes for Investors

Ratings reflect relative risk levels, not guarantees of repayment.

A lower-rated issuer may still be a good investment opportunity with higher expected returns but also with higher risk.

Alixco continues to monitor and update issuer ratings periodically based on payment performance and new financial data.

Investors are encouraged to diversify across different ratings to balance risk and return.

- How many campaigns can I invest in?

As many as you like!

Retail investors are encouraged to stay within a recommended maximum exposure of RM 50,000 across the platform. - Will Alixco or any of its associates compensate for any losses e.g. in case of a default? Are my investments or returns guaranteed by Alixco?

No. Like all investment platforms, Alixco acts solely as a market intermediary, not as a guarantor. This approach:

-

Keeps costs low

-

Increases return potential

-

Encourages transparent risk-reward alignment

There is no coverage from the Capital Market Compensation Fund, and no guarantees on capital or interest.

Investments made through the Alixco platform are not covered by the Capital Market Compensation Fund. This means any losses incurred cannot be claimed from the Fund.

-

- How does Alixco screen issuers and prevent scams?

We run a robust 3-step vetting process:

-

Financial & operational review

-

Credit checks and risk scoring (internal + Experian, CTOS)

-

Background & fraud checks (on directors & business)

Only issuers who meet our minimum risk and due diligence standards are listed.

-

- Do I need to pay taxes on my investment returns?

Yes. Your investment income is subject to personal income tax in Malaysia.

We recommend consulting your tax advisor on how to report these earnings. - What happens if Alixco ceases operations or there is any bankruptcy?

Your money is securely placed in a Trust account with a major Malaysian bank. Alixco has a living will in place for this scenario so that you will get back your money.

In the unlikely event that Alixco ceases operations due to insolvency or other circumstances, a Business Continuity Plan will be activated to ensure investors' interests are protected.

Under a "Living Will" agreement, Alixco has appointed Crowd Tech Nominee Sdn Bhd as the Inheriting Partner to take over all outstanding investment obligations. This means:

The Inheriting Partner will continue managing investment notes, collection services, and recoveries on behalf of investors.

Late payments and outstanding amounts will still be collected and redistributed until all obligations are fulfilled.

Investors' funds and repayments remain safeguarded under the nominee structure.

This ensures that in the event of Alixco's closure, all live investment notes will continue to be administered efficiently, with recovery processes carried out as needed. - Is Alixco a financial advisor?

No, Alixco is not a financial advisor. P2P investments may or may not be suitable for your particular situation. Please consult with your personal financial advisor about the suitability of P2P investments with regard to your own personal (financial) situation, investment goals and level of risk tolerance before making any investment.

- Why shall I apply for P2P financing?

If you're a growing SME, you may have faced strict credit requirements or slow turnaround times from banks. At Alixco, we provide a fast, flexible, and transparent alternative:

-

Raise RM 50,000 – RM 5 million

-

Short 1–12 month financing tenures

-

Disbursement in as little as 1–7 days

-

Fully online process

-

Competitive interest rates as low as 8% p.a. (8% p.a. - 18% p.a. depending on your company's risk score)

With Alixco, you tap into a diverse pool of investors while keeping full control of your business.

-

- How to get started?

Sign up in just a few clicks at

www.alixco.com/registerOnce registered, you'll be guided step-by-step to:

-

Submit documents

-

Fill in your campaign details

-

Undergo credit review

-

Launch and raise funds!

-

- Who can be the issuer?

An issuer can be sole proprietorships, partnerships, limited liability partnerships, private limited and non-listed public companies. The following entities are prohibited from raising funds through a P2P platform:

(a) Commercially or financially complex structures (i.e. investment fund companies or financial institutions)

(b) Public-listed companies and their subsidiaries;

(c) Companies with no specific business plan or its business plan is to merge or acquire an unidentified entity (i.e. blind pool)

(d) Companies that propose to use the funds raised to provide loans or make investment in other entities

(e) Any other type of entity that is specified by the SC. - Is there a minimum an issuer can raise?

The minimum amount per campaign is RM 50,000.

- How much money can an issuer raise?

There is no SC-imposed cap, but at Alixco:

-

You can generally raise up to RM 5 million cumulatively

-

Campaigns must hit at least 80% of target to be successful

-

Oversubscription is refunded to investors (you don’t keep excess

-

The final approved amount depends on your risk score, credit limits, and campaign strength?

-

- Why do you require documents?

To comply with SC regulations and to give investors confidence, we require:

-

Business registration and forms (e.g. SSM docs)

-

Audited/management accounts

-

Bank statements

-

Guarantor NRICs

-

Credit bureau consent

We treat your data with strict confidentiality.

-

- Over what timeframe can I raise finance?

Flexible repayment terms of 1 to 12 months (and up to 24 months in specific cases). We also offer invoice financing and factoring options for working capital needs.

- How many details will investors see about my campaign?

At Alixco, we aim to be as transparent as possible for both investors and issuers. This might also help investors on the platform get more confidence in financing your business. Investors will be able to see your company name, business description, incorporation numbers, risk evaluation, the amount you seek to raise, the interest rate, loan tenure, purpose of the loan and a few key financial metrics such as revenue/earnings growth, EBIT and cash flow.

- How much time does it take to prepare and launch the campaign?

-

Preparation: ~1 day - 7 days (depending on your readiness)

-

Fundraising duration: Up to 30 days

-

Strong campaigns often get fully funded in hours!

-

- How long does it take to find investors?

This depends on a variety of factors such as the amount an issuer seeks for financing, the interest rate and the strength of the business. Campaigns will be left open for financing for up to 30 calendar days. Strong campaigns might already close within hours!

- When will be the monthly repayment date?

Monthly repayment dates will be set on the date of disbursal of the fund to your account.

- What interest rates can I expect to pay?

Alixco uses a risk-based pricing model:

-

Strong businesses: 8%–12% p.a.

-

Typical range: 12%–16% p.a.

-

Higher-risk notes: Up to 18% p.a.

Your rate is determined by credit score, financials, and guarantor profile

-

- How is the interest rate calculated?

We will aim to give you competitive ratings and calculate the interest rate based on the riskiness of the issuer’s business (risk-based pricing). This includes both quantitative and qualitative criteria which are specified in our proprietary algorithm and will then be matched with our risk-based table.

- How are repayments done?

Via equal monthly instalments (amortizing) over the financing tenure for the majority of cases. In certain cases, bullet repayments may be offered as a funding option.

All payments go through a Maybank Trustee Account for security. - How much does Alixco P2P Financing charge?

Alixco charges an origination fee of the total amount financed of between 2-6%. The fee is dependent on the riskiness of the issuer, tenure, investment size and any additional services requested by the issuer.

There are also upfront due diligence fee to pay upon applying the financing: RM 100 per director (non-refundable)

Retention charge: a security deposit will be deducted from the financing amount (successfully financed) from issuers to cover for administrative charges in the event of default. This charge is fully refundable and will be returned to the issuer in case the issuer does not default on any payments and does not have any late payments or breach any terms of any agreement. Usually this security deposit amounts to 10% of the fundraising amount. The security deposit may vary and be higher in case of certain high-risk P2P investment notes (usually grade C P2P investment notes).

- How does AlixCo assess my creditworthiness?

Alixco assesses a businesses’ creditworthiness according to a set of quantitative and qualitative criteria. The quantitative part includes an assessment of key financial ratios and financial statements. AlixCo will also perform a check on the issuer’s creditworthiness with a leading credit rating agency.

- Why was my application declined?

You are very happy to reapply. Maybe your business was not ready yet. Alixco reserves the right to decline a campaign in certain cases such as: weak credit score of company.

- Do you require collaterals?

Yes, we will require a personal guarantee by all directors, at least minimum of two guarantors. This also serves as a positive signal to investors of the good intention of the issuer to repay the outstanding amount.

- What is equity crowdfunding and how can it benefit my business?

Equity crowdfunding is a method of raising capital by selling shares of your company to a large number of investors through an online platform. It can benefit your business by providing access to capital, increasing brand awareness, and engaging with a community of investors.

- How do I raise funds through equity crowdfunding?

To raise funds through equity crowdfunding, you can apply to become listed on Alixco by submitting an application via Get Financed after you register and login to your Alixco account. The first steps are simple, just submit your business plan, financials (if available) and a compelling pitch and we will be in touch soon discussing the next steps with you.

- Who can raise capital through an ECF platform?

Only locally incorporated (in Malaysia) companies and limited liability partnerships (excluding exempt private companies) will be allowed to be hosted as an ECF issuer.

- What types of businesses are suitable for equity crowdfunding?

Equity crowdfunding is suitable for a wide range of businesses, including startups, early-stage companies, and growth-stage companies across various industries. Businesses should have a scalable business model, a compelling value proposition, and a clear growth strategy.

- What are the costs associated with raising funds through equity crowdfunding?

Costs associated with equity crowdfunding may include platform fees, legal fees, marketing expenses, and compliance costs. It's essential to consider these costs when planning your fundraising campaign. Alixco typically charges a 5-7% success-only fee and a 1% sign-up fee. The 1% sign up fee is usually between RM 2,000 and RM 15,000, depending on the deal size and complexity.

Additional fees such as lawyer or consulting fees may apply but typically do not exceed 2% of the targeted funding amount. Hence, most businesses can expect an overall funding cost of 7%– 9% of the funding amount.

- How much capital can I raise through equity crowdfunding?

An issuer may only raise collectively, a maximum amount of RM20 million through ECF platforms in its lifetime. This amount is excluding the issuer’s own capital contribution or any funding obtained through a private placement exercise.

- Is an issuer allowed to keep the funds raised on an ECF platform if it is less than the target amount?

The concept of ‘all or nothing’ is applied to the ECF fundraising exercise. In this regard, an issuer must raise the targeted amount from investors, or the campaign is considered unsuccessful. When the ECF campaign is unsuccessful, all monies collected are returned to the investors. A targeted range of fundraising amount (minimum and maximum amount) is set for each ECF campaign.

- Is an issuer allowed to keep the funds raised on an ECF platform if it exceeds the target amount?

The issuer is only allowed to keep the funds raised within the targeted range of fundraising amount (minimum and maximum amount). A campaign is considered successful once the targeted amount sought to be raised has been met.

- Can an issuer raise funds concurrently on multiple ECF platforms?

No. An issuer can only raise funds on one ECF platform at any one time. An issuer may be permitted to be hosted on an ECF platform and peer-to-peer (P2P) platform at the same time, subject to disclosure requirements as may be specified by the platform operators.

- What information do I need to provide to investors on the platform?

As part of your fundraising campaign, you'll need to provide investors with detailed information about your business, including your business model, financial projections, use of funds, and potential risks. Transparency and clarity are key to attracting investor interest.

- How long does it take to raise funds through equity crowdfunding?

The time it takes to raise funds through equity crowdfunding can vary depending on factors such as the attractiveness of your investment opportunity, investor demand, and market conditions. On average, the actual fundraising period lasts for 90 days while the whole crowdfunding process from application to disbursement in case of success usually takes about 2 – 6 months.

- Can I raise funds through equity crowdfunding if my business is not profitable yet?

Yes, equity crowdfunding allows businesses at various stages of growth, including pre-revenue and early-stage companies, to raise funds from investors. However, you'll need to clearly communicate your business's growth potential and value proposition to attract investor interest.

- What are the regulatory requirements for raising funds through equity crowdfunding?

Businesses raising funds through equity crowdfunding must comply with regulatory requirements set by the Securities Commission Malysia, including disclosure obligations, investor limits, and reporting obligations. Alixco is checking that your company’s campaign meets regulatory requirements. Furthermore, Alixco has a trusted legal partner firm which can support in the legal document creation for your pitch.

- How does the SC regulate equity crowdfunding activities in Malaysia?

The SC regulates equity crowdfunding (ECF) activities in Malaysia by registering the ECF operators (ECF operators) as recognised market operators pursuant to the Guidelines of Recognized Markets (RMO Guidelines).

The RMO Guidelines, among others, sets out registration requirements and imposes a set of obligations applicable to an ECF operator. Ongoing obligations imposed on an ECF operator include ensuring compliance with disclosure requirements and governance arrangements, carrying out due diligence exercise on prospective issuers planning to use its platform and ensuring investors’ monies are properly safeguarded.

- How does the platform support businesses throughout the fundraising process?

Alixco provides support to businesses throughout the fundraising process, including guidance on campaign preparation, marketing support, investor relations, and compliance assistance to ensure regulatory compliance and investor confidence.

- How do I determine the valuation of my company for an equity crowdfunding campaign?

Valuing your company for an equity crowdfunding campaign requires careful consideration of factors such as revenue, growth potential, market comparables, and investor expectations.

There are different valuation methods used for each business stage, industry and company particulars. The most common (simple) valuation methods include 1. Multiples valuation which bases the value of your company on comparable companies and transactions 2. Discounted Cash Flow analysis (DCF) which bases valuation the expected cash flows the business will generate and 3, Startup valuation which sums up value components based on how strong the characteristics of your startup are.

Alixco can support your business with expert guidance on determining a valuation for your business which is both attractive to you as a business owner and to potential investors.

- What type of documentation do I need to prepare for an equity crowdfunding campaign?

Documentation for an equity crowdfunding campaign usually include a business plan, financial statements, offering documents, investor presentations, and legal agreements. It's essential to provide clear and comprehensive information to potential investors.

- How long does it take to prepare for an equity crowdfunding campaign?

The timeline for preparing an equity crowdfunding campaign can vary depending on factors such as the complexity of your business, the completeness of your documentation, and your readiness to engage with investors. On average, it may take several weeks to a few months to prepare for a campaign. Historically, 1 months – 3 months has been an approximate duration.

- What are the key milestones or metrics investors typically look for in a business?

Investors typically look for key metrics such as revenue growth, customer acquisition, market traction, product development milestones, and profitability projections. Highlighting these metrics can increase investor confidence in your business.

- Can I raise funds through equity crowdfunding if my business has already received funding from other sources, such as venture capital or angel investors?

Yes, businesses that have received funding from other sources can still raise funds through equity crowdfunding. However, it's essential to disclose existing funding arrangements and ensure alignment with prospective investors.

- How can I promote my equity crowdfunding campaign and attract investors?

Promoting your equity crowdfunding campaign requires a multi-faceted approach, including online marketing, social media outreach, investor networking, and engaging with potential investors through the platform's online portal.

- What are the reporting requirements after successfully raising funds through equity crowdfunding?

After successfully raising funds through equity crowdfunding, businesses are typically required to provide regular updates to investors on the progress of the business, financial performance, and any significant developments. Compliance with reporting requirements is essential for maintaining investor trust and confidence. An update to investors is expected and required at least on a yearly basis.

- Can I set a funding target lower than the maximum allowable limit for equity crowdfunding campaigns?

Yes, businesses can set funding targets lower than the maximum allowable limit for equity crowdfunding campaigns. However, it's essential to consider the funding needed to achieve your business objectives and adequately communicate your funding goals to potential investors.

- What support does the platform provide to businesses during and after the fundraising process?

Alixco offers support to businesses throughout the fundraising process, including campaign preparation, marketing assistance, investor relations, and compliance guidance. Ongoing support after the fundraising process (after fundraise support may incur additional charges) may include support on investor updates, reporting assistance, and networking opportunities.

- What is equity crowdfunding?

Equity crowdfunding is a method of raising capital in which businesses sell shares of their company to a large number of investors through an online platform.

- How does ECF work? (SC)

ECF is an online fundraising platform for start-ups or micro, small and medium enterprises (MSMEs) to raise early-stage financing from a group of investors.

Investors who provide financing to the start-up or MSME via ECF will receive equity or shares from the company and will become one of the shareholders of the company. Over time, if the company’s business does well, the investor who is now a shareholder will benefit from either the potential dividend paid out by the company; sale of the shares to new investors or if the company becomes eligible to list on the stock exchange.

- Who can invest through an ECF platform?

ECF investment opportunities are open to all investors.

There are three types of investor categories:

- Retail Investor

- Refers to an individual who is not an angel investor or a sophisticated investor.

- Angel Investor

- who is a tax resident in Malaysia and Public (Umum) OR

- whose total net personal assets exceed RM3 million or its equivalent in foreign currencies OR

- whose gross total annual income is not less than RM180,000 or its equivalent in foreign currencies in the preceding 12 months OR

- who, jointly with his or her spouse, has a gross total annual income exceeding RM250,000 or its equivalent in foreign currencies in the preceding 12 months.

- Sophisticated Investor

- is determined to be a sophisticated investor under the Guidelines on Categories of Sophisticated Investors OR

- acquires any capital market product or Islamic capital market product offered or traded on a recognized market where the consideration is not less than RM250,000 or its equivalent in foreign currencies for each transaction whether such amount is paid for in cash or otherwise

ECF represents an additional investment asset class where investors can have the option to diversify their investments beyond the traditional asset classes to suit their goals and risk profile. Remember to ask questions, read all information given carefully, and seek independent financial advice before committing yourself to any investment.

- Retail Investor

- Retail Investor

Refers to an individual who is not an angel investor or a sophisticated investor.

Additional comment: most investors will fall into this category unlees you meet the criteria in the "angel investor" or "sophisticated investor" sections e.g. a net worth over RM 3 million.

- Angel Investor

Refers to an individual—

(a) who is a tax resident in Malaysia; and

(b) whose total net personal assets exceed RM3 million or its equivalent in foreign currencies; or

(c) whose gross total annual income is not less than RM180,000 or its equivalent in foreign currencies in the preceding 12 months; or

(d) who, jointly with his or her spouse,has a gross total annual income exceeding RM250,000 or its equivalent in foreign currencies in the preceding 12 months. - Sophisticated Investor

Please refer to the full Guidelines on Categories of Sophisticated Investors to see if you are a sophisticated investor.

To help you in deciding whether you may qualify and check more details, here is a shortened list of potential qualification criteria:

Sophisticated:

High-Net Worth Individual (HNWI):

- Total net personal assets exceeding RM3 million, with primary residence not more than RM1 million

- Total net joint assets with spouse or child exceeding RM3 million, with primary residence not more than RM1 million

- Gross annual income exceeding RM300,000 or RM400,000 jointly with spouse or child.

- Total net personal or joint investment portfolio exceeding RM1 million.

- Relevant qualifications with five years' finance-related experience.

- Membership in specified financial associations

Accredited Investor:

- Unit trust scheme, private retirement scheme, or prescribed investment scheme.

- Bank Negara Licensed or registered persons

- Exchange holding company, stock exchange, derivatives exchange, approved clearing house, central depository, or recognized market operator.

- Corporation licensed or approved for regulated activities by Labuan or foreign authorities.

- Bank or insurance licensee under Labuan Financial Services and Securities Act 2010.

- CEO or director of licensed entities.

- Closed-end fund approved by SC.

High-Net Worth Entity (HNWE):

- Trust company with assets over RM10 million.

- Public company approved by SC as trustee with assets over RM10 million.

- Corporation with total net assets over RM10 million.

- Partnership with total net assets over RM10 million.

- Statutory body with investment mandate and assets over RM10 million.

- Pension fund approved by Director General of Inland Revenue.

- What is a PEP and am I a PEP?

PEP refers to "Politically Exposed Persons" i.e. individuals who are or who have been entrusted with prominent public functions either in Malaysia or in any other country in the world.

In case you are a PEP, it is your obligation to mark yes to the PEP question in your user dashboard KYC section and/or inform Alixco immediately via email.

In simple terms, a Politically Exposed Person (PEP) means a high-profile, political individual or individual entrusted with prominent public functionsExamples are:

- heads of State, heads of government, ministers and deputy or assistant ministers;

- members of parliament or of similar legislative bodies;

- members of the governing bodies of political parties;

- members of supreme courts, of constitutional courts or of other high-level judicial bodies, the decisions of which are not subject to further appeal, except in exceptional circumstances; #

- members of courts of auditors or of the boards of central banks

- ambassadors, chargés d'affaires and high-ranking officers in the armed forces;

- members of the administrative, management or supervisory bodies of State-owned enterprises;

- directors, deputy directors and members of the board or equivalent function of an international organisation.

In case you are a family member or close associate of a PEP, you must also mark yes to the PEP question in your user dashboard KYC section and/or inform Alixco immediately via email.

Family members include the following:

- The spouse, or a person considered to be equivalent of a spouse, of a politically exposed person;

- The children and their spouses, or persons considered to be equivalent to a spouse of a politically exposed person

- The parents of a politically exposed person;

Persons known to be close associates means:

- natural persons who are known to have joint beneficial ownership of legal entities and legal arrangements or any other close business relations, with a politically exposed person;

- natural persons who have sole beneficial ownership of a legal arrangements which is known to have been set up for the de facto benefit of a politically exposed person.

- How do I invest in equity crowdfunding?

To invest in equity crowdfunding, you can sign up via the Register button on Alixco or log into your existing Alixco account, browse available investment opportunities via “Invest ECF”, and choose to invest in businesses that align with your investment goals. You will be required to fill out an investor notification/warning to determine if you are allowed to proceed.

In general, upon understanding and analysing the information disclosed by issuers concerning its business, financing purpose, financial information and risk information published on the ECF platform, an investor will then make an informed investment decision on the issuer, including the amount they wish to invest in.

Investors are advised to evaluate and understand investment risks before making any investment decisions. Investing in start-ups and early-stage businesses involves high risks, including loss of investment, illiquidity, lack of dividends and dilution, and it should be done only as part of a diversified portfolio.

- What are the potential returns on equity crowdfunding investments?

The potential returns on equity crowdfunding investments can vary widely depending on the success of the business. While some investments may result in significant returns, others may not yield any returns or may even result in a loss.

- What type of shares are offered?

Each issuer offers a certain type of shares to investors. This may be pure equity (direct shares) or preference share or a variety of it. ECF shares on Alixco are usually so called RCPS = redeemable convertible preference shares. Investors should always read the investment overview sheet to fully understand the characteristics, rights, opportunities and limitations of the shares offered.

- What are the risks associated with equity crowdfunding?

Equity crowdfunding investments carry inherent risks, including the potential loss of the entire invested capital. Factors such as business failure, market conditions, and regulatory changes can impact the success of investments.

- How much can I invest in equity crowdfunding?

The amount you can invest in equity crowdfunding typically depends on your jurisdiction's regulations and the specific platform's policies. In Malaysia, retail investors are subject to investment limits set by the Securities Commission.

A person may invest in any issuer hosted on the ECF platform, subject to the following limits:

Investment Limit

Retail investor

Maximum RM 10,000 for retail investors for a single investment and, no more than RM50,000 within a 12-month period

Angel investor

Up to RM500,000 for angel investors within 12 months

Sophisticated investor

No investment limit

- Can I invest in equity crowdfunding if I'm not a Malaysian citizen or resident?

Depending on your jurisdiction and regulations in your country of nationality and residence, non-Malaysian investors may be allowed to participate in equity crowdfunding campaigns. However, it's essential for investors to verify eligibility e.g. with a lawyer and/or tax advisor and comply with any applicable regulations in your jurisdiction.

- Is there any cooling-off period for investments made on an ECF platform?

ECF investors are given a six business days cooling-off period, within which they may withdraw the full amount of their investment. In addition, if there is any material adverse change relating to an issuer, the investors must be notified of such change.

- How do I evaluate investment opportunities on an equity crowdfunding platform?

When evaluating investment opportunities, consider factors such as the business model, market potential, management team, financial projections, and exit strategy. Conduct thorough due diligence and seek advice from financial professionals if needed.

- Can I sell my equity crowdfunding investments before the business exits or goes public?

In most cases, equity crowdfunding investments are illiquid, meaning you cannot easily sell your shares before the business exits or goes public. You may have to wait for a liquidity event such as an acquisition or IPO, which may take years or decades or may never be realized.

- Are there any tax implications associated with equity crowdfunding investments?

Tax implications vary depending on your jurisdiction, nationality and place of residence and the specific nature of your investments. Consult with a tax advisor to understand how equity crowdfunding investments may affect your tax situation.

- Is there a guaranteed return?

It is important to highlight that investments in ECF issuers have NO GUARANTEE of return. Investments in ECF issuers are typically binary i.e. usually either leading to the loss of the entire investment or to attractive returns. Moderate losses or moderate returns may also happen but tend to be less frequent.

- Will Alixco compensate me for any losses?

It is important to highlight that Alixco solely acts as a platform operator connecting issuers with investors and Alixco will not compensate investors for any losses or associated direct, indirect, incidental or consequential damages as a result of any investment made via the platform online or offline.

- How does the platform ensure investor protection?

Alixco is required to adhere to regulatory standards and implement investor protection measures, such as due diligence on businesses, transparency in disclosures, and compliance with regulatory requirements.

- How does the SC regulate equity crowdfunding activities in Malaysia?

The SC regulates equity crowdfunding (ECF) activities in Malaysia by registering the ECF operators (ECF operators) as recognised market operators pursuant to the Guidelines of Recognized Markets (RMO Guidelines).

The RMO Guidelines, among others, sets out registration requirements and imposes a set of obligations applicable to an ECF operator. Ongoing obligations imposed on an ECF operator include ensuring compliance with disclosure requirements and governance arrangements, carrying out due diligence exercise on prospective issuers planning to use its platform and ensuring investors’ monies are properly safeguarded.

- What happens when there is a complaint or dispute regarding the investment?

Investors can report any complaint or dispute regarding the investment to report.misconduct@alixco.com and the complaint or dispute will be investigated immediately. Alternatively, you may lodge your complaint regarding your ECF investment by contacting the Consumer & Investor Office (CIO) of the SC.

- What are the fees associated with investing in equity crowdfunding?

Investors may incur fees such as platform fees, transaction fees, and performance fees. These fees can vary depending on each deal. Typically Alixco charges ECF investor a small fee for transactions and a performance profit fee of 10% ( or between 0% - 20%) on any distributions or returns from ECF investments, which means investors typically get to keep between 80% to 100% of the profits made subject to taxes. Investor should carefully read each investment pitch to understand the costs and fees applicable for each deal.

- How do I access information about investment opportunities on the platform?

Registered investors can access information about investment opportunities through the Alixco’s ECF portal, which includes current deals with details such as company profiles, financial projections, investment terms, and risk factors.

- Are there any restrictions on selling my equity crowdfunding investments after purchasing them?

Equity crowdfunding investments are generally illiquid, meaning you cannot easily sell your shares on a secondary market. You may need to hold your investments until a liquidity event occurs, such as an acquisition or IPO. You may have to wait for a liquidity event such as an acquisition or IPO, which may take years or decades or may never be realized.

- How can I diversify my investment portfolio through equity crowdfunding?

Equity crowdfunding platforms offer a diverse range of investment opportunities across various industries and sectors. By investing in multiple campaigns, you can spread your risk and diversify your portfolio.

- What happens if the business I invested in fails or goes bankrupt?

In the event of business failure or bankruptcy, investors may lose some or all of their invested capital. It's essential to assess the risk factors and potential outcomes before making investment decisions.

- How can I stay updated on the progress of my investments?

Issuers are expected to provide investors with regular updates on the progress of their investments, including financial performance, company updates, and any significant developments on a regular basis.

- What happens if the business I invested in gets acquired or goes public?

If the business you invested in gets acquired or goes public, you may have the opportunity to realize returns on your investment through a buyout or the sale of shares on a public exchange. These returns can either be substantially negative e.g. a 99% loss or substantially positive e.g. a 100% or 1000% gain.

- What happens to my money in case something happens to Alixco e.g. bankruptcy?

Your money is securely placed in a Trust account with a major Malaysian bank. Alixco has a living will in place for this scenario so that you will get back your money.

In the unlikely event that Alixco ceases operations due to insolvency or other circumstances, a Business Continuity Plan will be activated to ensure investors' interests are protected.

Under a "Living Will" agreement, Alixco has appointed Crowd Tech Nominee Sdn Bhd as the Inheriting Partner to take over all outstanding investment obligations. This means:

The Inheriting Partner will continue managing investment notes, collection services, and recoveries on behalf of investors.

Late payments and outstanding amounts will still be collected and redistributed until all obligations are fulfilled.

Investors' funds and repayments remain safeguarded under the nominee structure.

This ensures that in the event of Alixco's closure, all live investment notes will continue to be administered efficiently, with recovery processes carried out as needed.

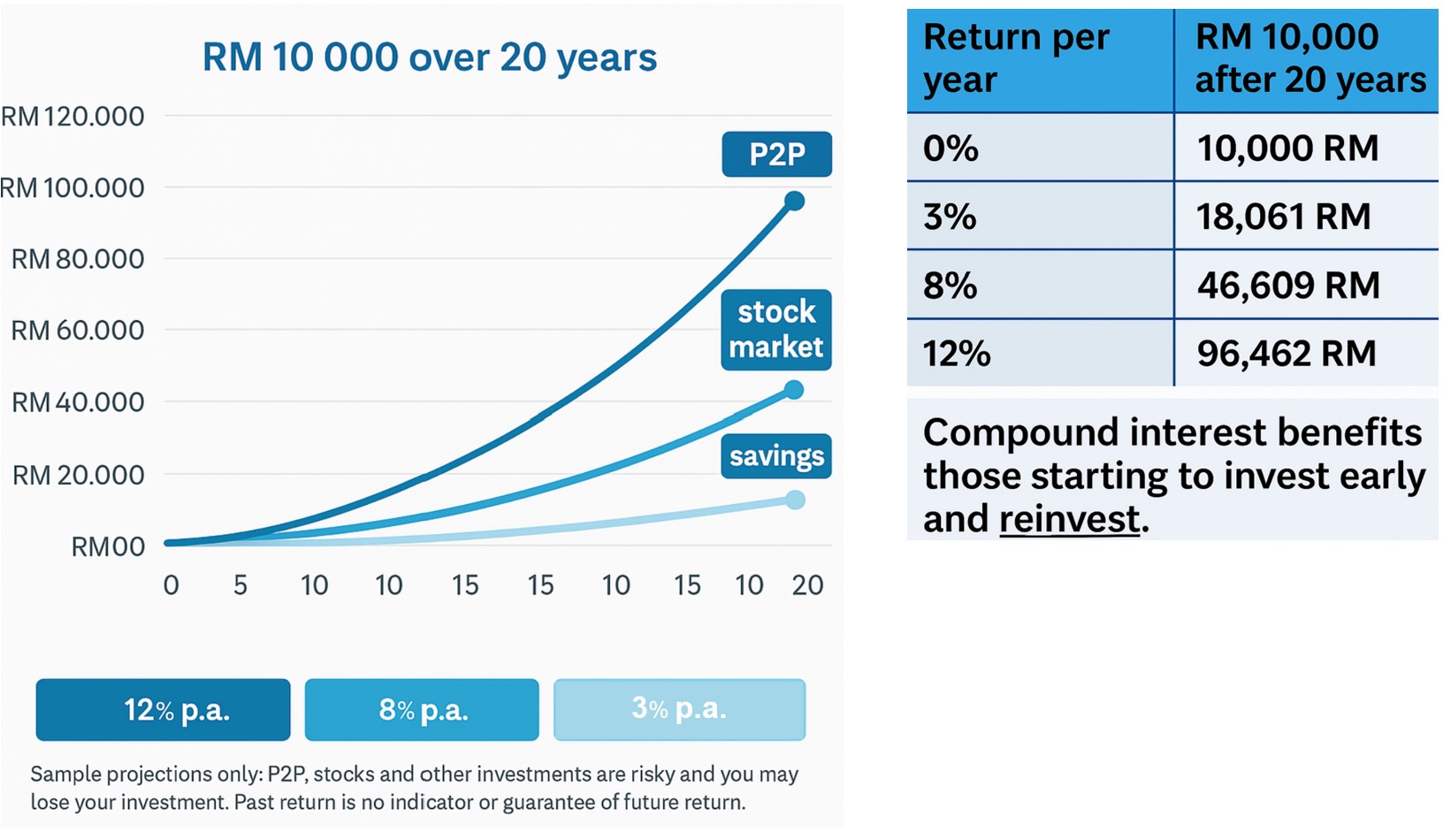

- Alixco offers up to 10%+ annual returns. Over 97% historical repayment rate. Only 2.62% low default rate since 2018. Trusted P2P investment platform in Malaysia.

Alixco P2P Investment Returns, Risk Ratings & Market Statistics

High Potential Returns for Alixco Investors – Up to 11.26% p.a. Net Return p.a. . Important Info: Capital at risk.

At Alixco, investors have consistently achieved strong returns through our peer-to-peer (P2P) financing platform in Malaysia.

From our launch in 2018 until January 2025, the net average annual return (after fees and defaults) for investors was exceeding 10% p.a. (nominal) , with many investors earning even more depending on portfolio choices and diversification.

The average interest rate for business financing notes listed on Alixco stood at 13.52% p.a. (nominal), showcasing the attractive yield potential of our platform.

These statistics are based on over seven years of real investment data, highlighting our strong track record and commitment to delivering reliable returns in Malaysia’s fast-growing P2P lending sector.

At Alixco, we remain committed to:

- Offering high-quality investment notes with above-average returns

- Conducting thorough due diligence on all borrower businesses

- Empowering investors with transparency, diversification options, and a robust risk framework

Whether you're a seasoned investor or just getting started, Alixco offers one of the most rewarding and trustworthy P2P investment experiences in Malaysia.

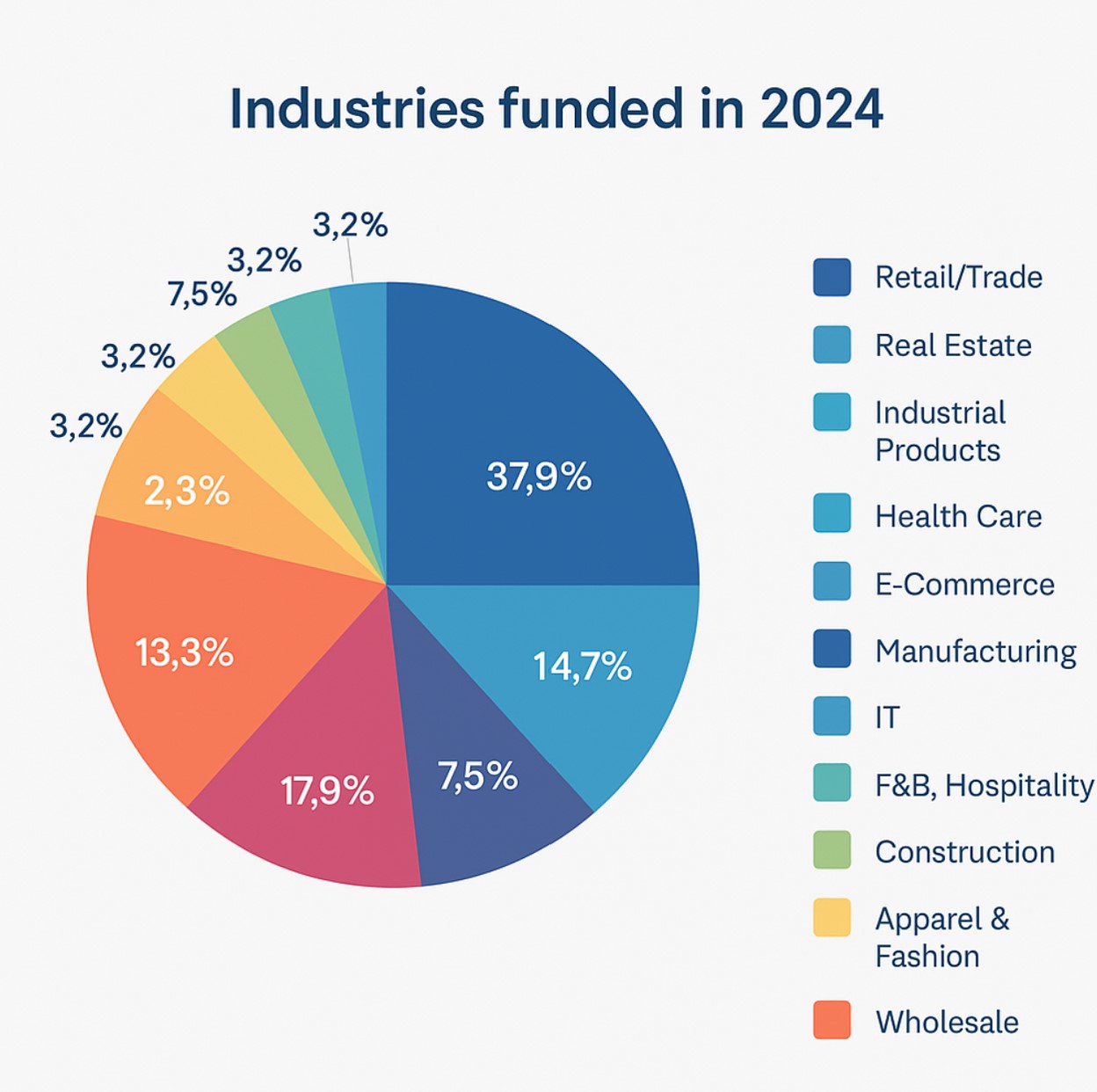

- Diversified Industry Exposure – P2P Investments Across Malaysia’s Key Sectors

In 2024, Alixco funded businesses across a wide range of industries, offering investors broad exposure and diversified risk.

The Retail/Trade sector led with 37.9% of total funded volume, reflecting strong demand from consumer-facing businesses.

Manufacturing and Wholesale followed at 17.9% and 13.3%, respectively, highlighting our support for Malaysia’s industrial backbone.

Other notable sectors included Real Estate (14.7%), IT (7.5%), F&B/Hospitality (7.5%), and E-Commerce, Healthcare, and Construction – each at 3.2%.

This diverse portfolio enables Alixco investors to benefit from multiple economic growth drivers while minimizing reliance on any single sector.

At Alixco, we carefully vet businesses from both emerging and established sectors—ensuring every note meets our standards for quality, transparency, and return potential

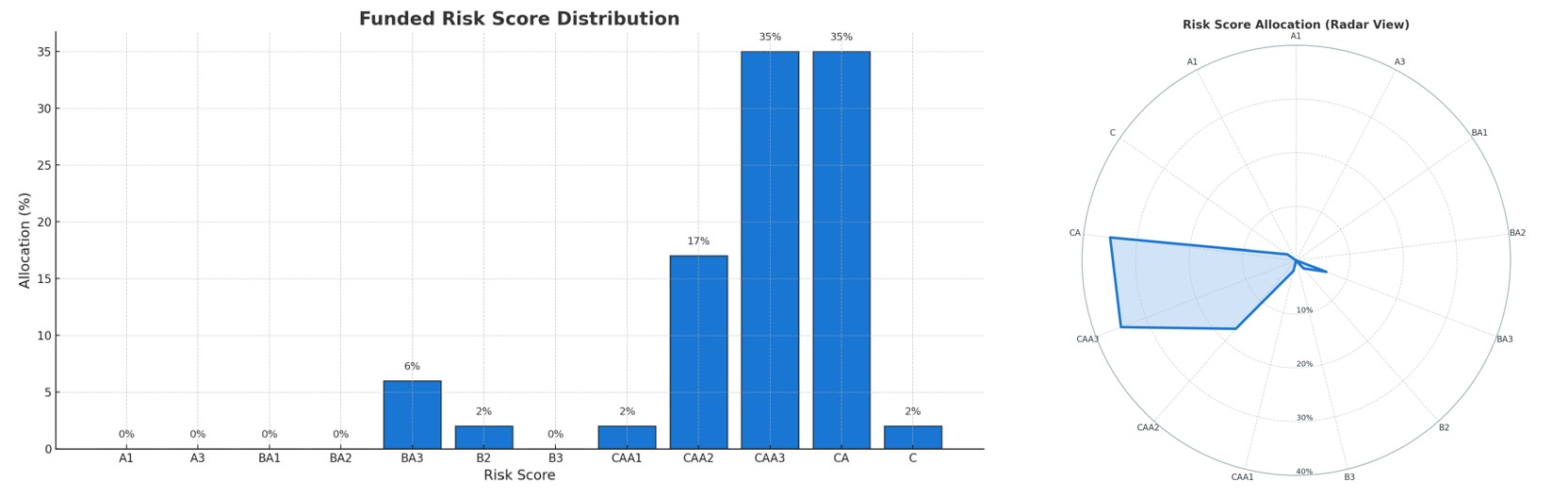

- Distribution of risk scores

Balanced Risk Allocation – Insight into Funded Risk Scores

At Alixco, we maintain a transparent and data-driven approach to risk assessment. The majority of funded notes in 2024 were allocated to mid-risk and high-risk categories, offering an optimal balance of attractive returns and manageable risk for investors.

70% of all funded notes were rated CAA2 (35%) and CAA3 (35%), which historically offer higher yields while maintaining a controlled default rate through strict vetting.

17% were rated CA, while small allocations were made to medium--risk ratings like BA3 (6%) and B2/B3/CAA1/C (2% each).

No allocations were made to A-rated categories, as these segments often carry lower yield potential inconsistent with our investors’ return targets.

The radar chart provides a visual overview of risk exposure concentration, helping investors better understand the credit distribution of Alixco’s investment opportunities.

By focusing on disciplined risk selection, Alixco aims to maximize investor returns while actively managing credit exposure across Malaysia’s growing business landscape.

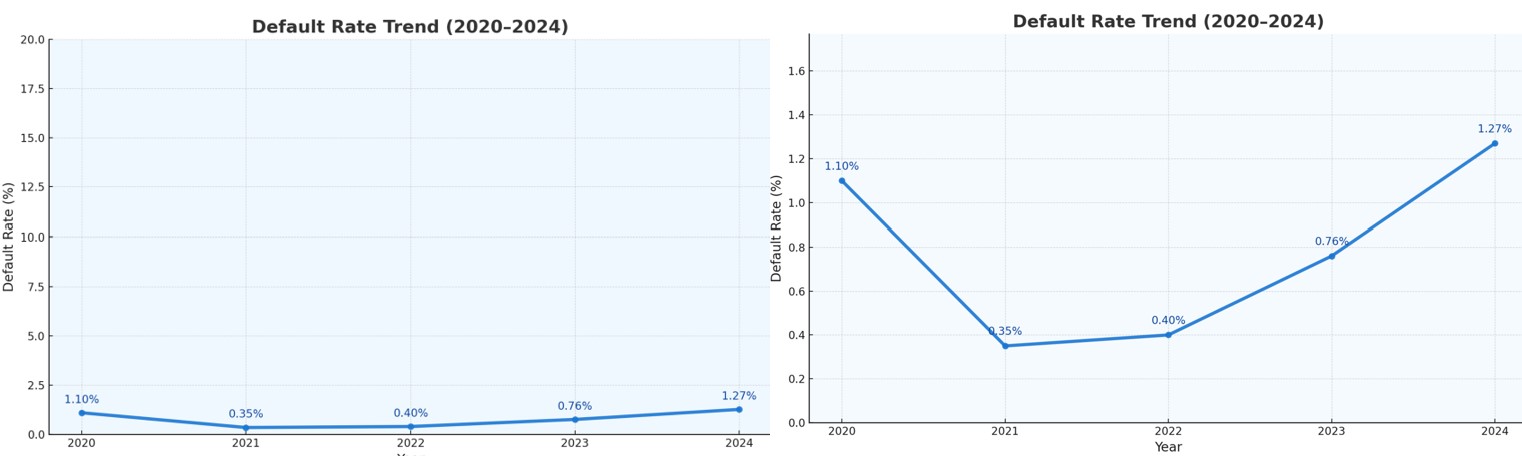

- Strong Repayment Performance – Over 97 % of Alixco Investments Fully Repaid

At Alixco, investor protection and repayment reliability are at the core of our platform.

Since our inception, over 97% of investments have been fully repaid, with a low default rate of just 2.62%, as of 15 October 2025. Based on repayment value, our business financing investment notes have achieved a repayment rate exceeding 97% — a strong indicator of our platform’s credit quality and risk management.

Default Rate (as defined by the Securities Commission Malaysia): 2.62% (15th October 2025)

Number of unique issuers with notes in default (>90 days late): 5

Alixco continues to enhance both its mathematical credit scoring models and social-based risk assessment tools to reduce potential defaults and protect investor capital.

Our goal remains clear: to offer high-yield investments without compromising on due diligence or repayment performance, making Alixco one of the most trusted P2P investing platforms in Malaysia.

RMO-P2P Operators shall compute its default rate with the following formula and disclose the same on its platform:

i.e. The denominator will essentially be the amount financed plus the interest that is promised to investors at the point of issuance. This includes Active Notes, Defaulted Notes and Written Off Notes if any

Note:

Active Notes refers to notes issued on P2P Platform which are not in default

Defaulted Notes refers to notes which is classified as default as per P2P Operator's definition

Written Off Notes or any similar definition refers to notes which are in default and has not yet been recovered.

Please note that repayment rates, default rates and investment returns (both nominal and effective) are historical returns which have been realized on investment hosted on Alixco up the the stated date. Please note that these rates and returns are not necessarily an indication of future performance. Future default rates and investment returns may differ substantially from the stated historical default rate and returns.

- Investor Protection & Risk Safeguards

At Alixco, investor protection is a top priority. Our platform is designed to ensure secure, transparent, and reliable P2P investments through multiple layers of risk assessment, legal safeguards, and contingency planning.

Comprehensive Credit Analysis Process

Alixco implements a rigorous 3-step credit evaluation before funding any business financing investment note:Mathematical Z-Score Model: An internal, multi-factor scoring model based on key financial ratios of the issuer.

Third-Party Credit Rating: An additional score from Experian (formerly RAMCI), covering the credit history of the company and its directors.

Social Scoring Algorithm: Our proprietary model that evaluates the credibility and repayment behavior of key individuals associated with the business.

This layered approach enhances our ability to identify strong issuers and minimize default risk.

Personal Guarantees

Each business financing investment note requires at least two personal guarantees from key persons or directors, strengthening the enforceability of repayment obligations.Legally Binding Contracts

All investment notes are formal contractual agreements between the issuer and investor, backed by Malaysian stamp duty to provide legal enforceability in court if needed.Debt Recovery Partnerships

In the event of a default, Alixco works with a leading debt recovery agency to actively pursue and recover outstanding payments from issuers, maximizing potential recovery for investors.Living Will for Platform Continuity

To safeguard investors in the unlikely event of platform disruption, Alixco has a Living Will arrangement in place. This mandates that a designated law firm will take over the processing of all outstanding repayments until each note reaches maturity—ensuring business continuity and investor peace of mind.

- How to report misconduct/wrong doing of ALIXCO employees

We uphold a commitment to our clients, investors, communities and each other.

We build trust through integrity and high ethical standards outlined in the Alixco 'Code of Conduct'.

Staff members and users are urged to use intranet facilities for comprehensive guidance on raising concerns through various escalation channels.

If you observe any misconduct by Alixco employees or individuals representing the company, such as violations of laws, regulations, or industry codes, including environmental or human rights issues within Alixco's operations, report your concerns via email to report.misconduct@alixco.com . For other concerns, contact our client service officer.

You can make a report anonymously and all reports are treated confidentially by our 'Whistleblowing' central function and if necessary the internal investigation team will take appropriate action.

You may submit all corresponding complaints and any other complaints you have via report.misconduct@alixco.com for appropriate attention.

Alternatively, complaints may also be submitted via p2p@alixco.com , preferably with the remark "Complaint" in the header so it can automatically be redirected to the relevant officer or via +603 2728 1216 with a request for “FBM Crowdtech Sdn Bhd, Compliance Manager.

The Malaysia Whistleblower Protection Act 2010 safeguards whistleblowers who disclose alleged improper conduct by protecting their identities, granting immunity from civil and criminal proceedings, and preventing detrimental actions.

- Is it possible to make the report anonymously ?

You can make a report anonymously and all reports are treated confidentially by our 'Whistleblowing' central function and if necessary the internal investigation team will take appropriate action.

- Do I have any special rights as Whistleblower?

The Malaysia Whistleblower Protection Act 2010 safeguards whistleblowers who disclose alleged improper conduct by protecting their identities, granting immunity from civil and criminal proceedings, and preventing detrimental actions.